South Jersey Housing Market 2024: Insights and Trends You Need to Know

As we review the South Jersey Housing Market 2024, it's essential for buyers and sellers to stay informed about the shifting dynamics of Burlington County's real estate landscape. This comprehensive update will provide a detailed overview of market trends, key statistics, and actionable strategies for navigating this competitive environment.

Table of Contents

- Intro – South Jersey Real Estate Market Update

- 2024 Recap – What Shaped the Market in South Jersey?

- Burlington County Real Estate: Why This Market is So Competitive

- Burlington County Real Estate: Market Stats You Need to Know

- Mount Laurel: One of the Fastest Moving Markets

- Marlton Real Estate's Strong Growth and Fast Home Sales

- Moorestown: The Luxury Leader of Burlington County

- Lumberton Market Insights

- Medford Key Trends and Insights

- What’s the Most Popular Home in Burlington County?

- Why Inventory Is Low & What It Means for Buyers in 2025

- Mortgage Rates in 2024 – How Do They Impact Affordability?

- 3 Proven Strategies for Buying & Selling at the Same Time

- FAQ

Intro – South Jersey Real Estate Market Update

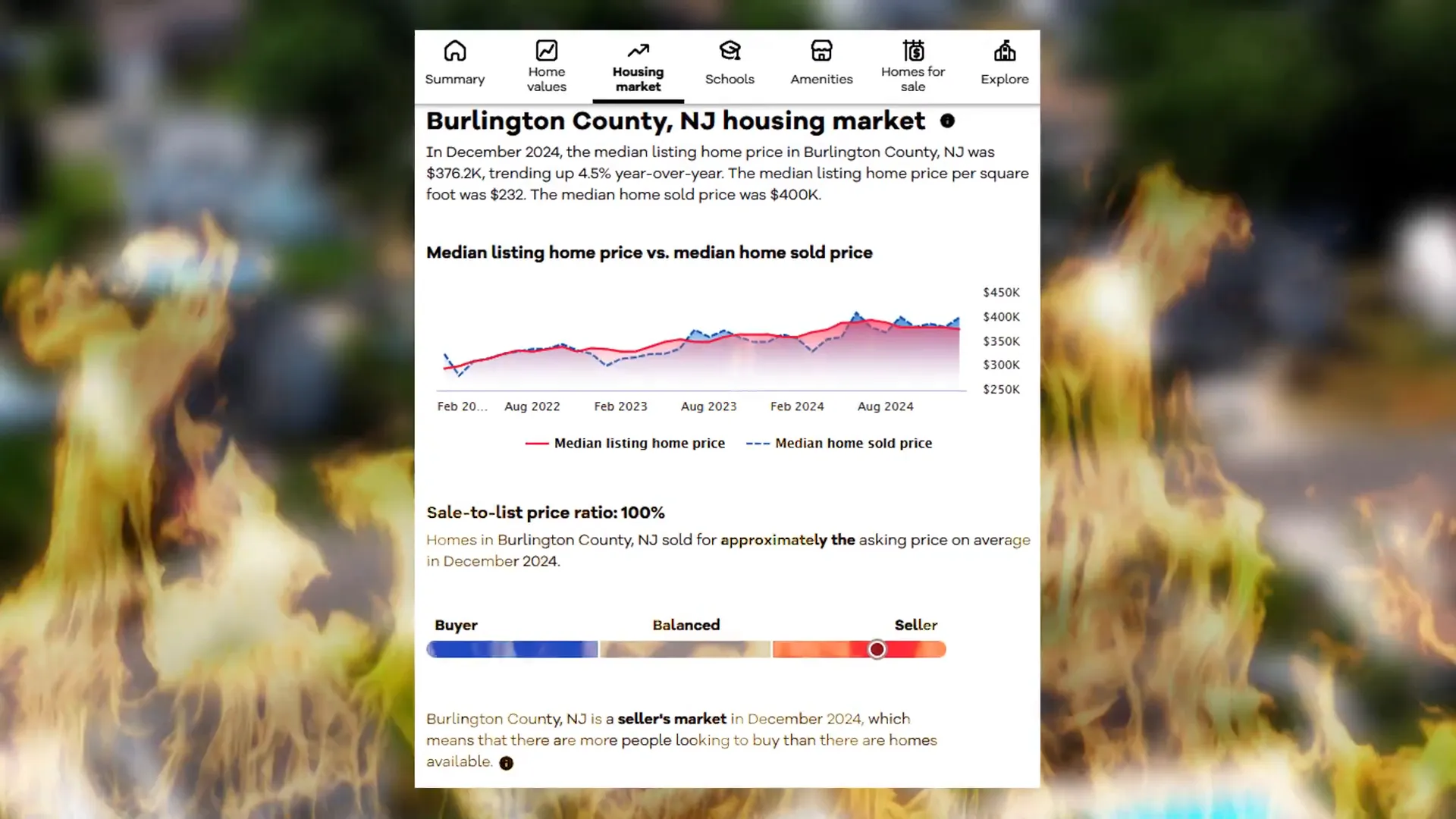

The South Jersey Housing Market in 2024 is marked by a flurry of activity as buyers seek homes and sellers take advantage of high demand. It is essential to grasp the specifics of Burlington County’s real estate scene, whether you are buying or selling. With only 1.3 months of inventory available, homes are selling quickly, averaging just 30 days on the market, making it vital for buyers to act fast.

As the market continues to thrive, families are drawn to the area's diverse offerings, including community amenities and strong school systems. By understanding the prevailing trends and insights, potential homebuyers and sellers can navigate this competitive landscape more effectively, ensuring they are well-prepared to make informed decisions in their real estate endeavors.

2024 Recap – What Shaped the Market in South Jersey?

As we reflect on 2024, several factors have significantly influenced the South Jersey Housing Market. The year was characterized by a mix of high demand and low inventory, which has kept prices on an upward trajectory. Despite rising mortgage rates, the desire for family-oriented homes in Burlington County remains strong, a testament to the area's appeal.

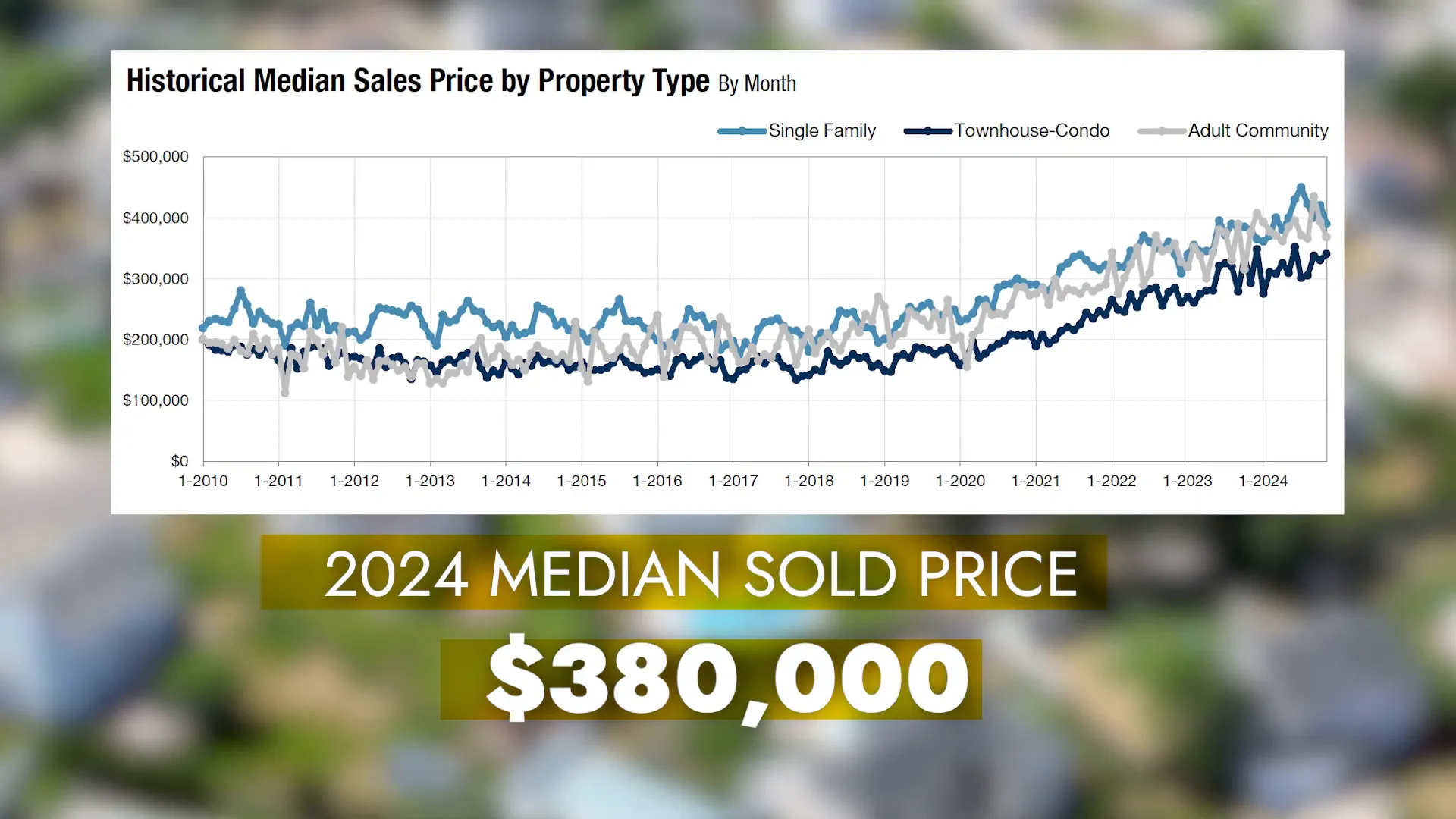

The total number of homes sold in Burlington County was 5,287, with a median sold price of $380,000. This aligns closely with the median list price, indicating a competitive marketplace where buyers are willing to meet sellers' expectations. Homes are selling quickly, with an average of just 30 days on the market, underscoring the urgency among buyers.

Burlington County Real Estate: Why This Market is So Competitive

Burlington County's real estate market is particularly competitive due to a combination of factors including low inventory and high buyer interest. With only 1.3 months of inventory available, if no new homes were listed, the market would sell out in just over a month. This stark contrast to the 4 to 6 months typically seen in a balanced market makes it a strong seller's market.

Additionally, the competitive nature of the market is fueled by a variety of family-friendly amenities and locations. Towns like Mount Laurel and Marlton have seen homes sell in about 20 days, further emphasizing the need for buyers to act fast. Understanding the unique characteristics of each town is key for potential buyers and sellers alike.

Burlington County Real Estate: Market Stats You Need to Know

To navigate the Burlington County real estate market effectively, it's essential to be aware of the key statistics that define it. For instance, the median home price has experienced consistent growth over the years, reflecting the sustained demand. In 2020, the median sold price was $333,000, which has increased to $380,000 in 2024.

Moreover, the average days on the market for homes have significantly decreased, showcasing the urgency in buyer behavior. With homes selling at a rapid pace, understanding these stats helps buyers make informed decisions about pricing and timing.

Mount Laurel: One of the Fastest Moving Markets

Mount Laurel stands out as one of the fastest-moving markets in Burlington County, with 729 homes sold in the past year. The median list price was $375,000, and homes typically sold for slightly above this price, highlighting the competitive nature of the area.

Families flock to Mount Laurel due to its excellent schools, numerous parks, and convenient access to major highways. With homes selling in an average of just 20 days, buyers must be prepared to act quickly to secure their desired property.

The diversity of housing options, from starter homes to upscale properties, makes Mount Laurel an attractive choice for buyers at various life stages. This versatility contributes to its reputation as a desirable market within Burlington County.

Marlton Real Estate's Strong Growth and Fast Home Sales

Marlton has demonstrated remarkable growth in the real estate sector, with 644 homes sold in 2024. The median list price reached $429,900, while the median sold price was slightly higher at $435,000. Homes in Marlton are selling at an impressive pace, averaging just over 20 days on the market, which highlights the intense demand for properties in this area.

This town is particularly appealing to families looking to upsize, thanks to its affordable price points compared to nearby luxury markets. The local amenities, including the Promenade shopping center, add to Marlton's charm, making it a prime location for those seeking convenience and community.

What sets Marlton apart is its strong appreciation in home values. Many properties are selling above their list price, indicating a competitive market where buyers must be prepared to act quickly. The average list-to-sold price ratio of 101% further emphasizes this trend.

Moorestown: The Luxury Leader of Burlington County

Moorestown continues to be the luxury leader of Burlington County, with 266 homes sold in 2024. The median list price stood at $750,000, but the median sold price was slightly lower at $725,000. Homes in this prestigious area typically take about 34 days to sell, which reflects the nature of the luxury market where buyers tend to deliberate before making decisions.

Known for its top-rated schools and charming downtown area, Moorestown offers a blend of luxury and community-focused living. The market here is more balanced, as evidenced by the 97% list-to-sold price ratio, suggesting that sellers need to align their pricing with buyer expectations to attract potential buyers.

Given the higher price point, buyers in Moorestown often take their time weighing options, making it crucial for sellers to price their homes competitively to avoid extended market times.

Lumberton Market Insights

Lumberton presents a stable and reliable market, with 103 homes sold in 2024. The median list and sold price were both $450,000, indicating a well-balanced market. Homes in Lumberton average just 22 days on the market, which showcases its appeal to buyers seeking a suburban lifestyle without the hustle and bustle of larger towns.

Buyers are drawn to Lumberton for its affordability and sense of community. The local proximity to natural areas like Rancocas State Park adds to its allure, making it an excellent choice for outdoor enthusiasts.

The fact that homes sell at their list price further underscores the market's consistency. Buyers can expect a stable environment when looking for properties in Lumberton, making it a solid choice for families and individuals alike.

Medford Key Trends and Insights

Medford is characterized as an upscale suburban retreat, with 393 homes sold in 2024. The median list price reached $589,000, while the median sold price was slightly lower at $585,500. Homes in Medford take an average of 27 days to sell, which is impressive given the higher price points in the market.

This town offers a unique blend of privacy, larger lots, and access to excellent schools, making it attractive for buyers looking for a serene lifestyle while remaining close to necessary amenities. The 98% list-to-sold price ratio reflects the demand for homes in this area, as buyers are willing to pay close to the asking price.

Medford's beautiful neighborhoods and proximity to lakes and trails make it a favorite among those prioritizing lifestyle over location. This balance is key to understanding the appeal of Medford in the South Jersey Housing Market 2024.

What’s the Most Popular Home in Burlington County?

When it comes to the most popular home type in Burlington County, the four-bedroom, two-and-a-half-bath home remains a favorite. These homes typically range between 2,000 and 3,000 square feet, catering to families looking for space and functionality. They often feature kitchens ample enough for pancake breakfasts, backyards for after-school soccer matches, and enough bathrooms to avoid morning bottlenecks.

Over the years, these homes have shown consistent appreciation, reflecting their high demand and central role in suburban life. In 2010, the average price for a four-bedroom home was $338,800, and it has steadily increased to $515,250 in 2024, marking a 62% increase over the last 15 years.

This trend is driven by a tightening inventory, especially for larger homes, which has elevated prices further. As families prioritize suburban living, the demand for these properties continues to grow, making them a solid investment for potential buyers.

Overall, the South Jersey Housing Market 2024 showcases a variety of dynamics across different towns, each catering to specific buyer needs and lifestyles. Understanding these trends is crucial for anyone looking to navigate the market effectively.

Why Inventory Is Low & What It Means for Buyers in 2025

The South Jersey Housing Market 2024 has been characterized by persistently low inventory levels, a trend that is expected to continue into 2025. A tight inventory means fewer homes are available for buyers, leading to increased competition and often higher prices. This situation is primarily driven by several factors.

Firstly, the construction of new homes has not kept pace with demand. Rising construction costs and supply chain issues have hindered the ability of builders to deliver new homes, particularly family-oriented properties. As a result, existing homes become even more valuable as buyers compete for limited options.

Secondly, many homeowners are choosing to stay put rather than sell, often due to the attractive mortgage rates they secured during the pandemic. This reluctance to move means fewer homes are listed, tightening the market further. As a consequence, buyers may face bidding wars and must act quickly when a suitable property becomes available.

For buyers entering the market in 2025, this means preparing for a highly competitive environment. It’s crucial to have your financing in order and be ready to make strong offers. Additionally, working with a knowledgeable real estate agent who understands the nuances of the South Jersey market can provide a significant advantage.

Mortgage Rates in 2024 – How Do They Impact Affordability?

Mortgage rates have been a significant factor influencing the South Jersey Housing Market 2024. Hovering between 6% and 7%, these rates have affected buyer affordability and willingness to enter the market. Although these rates are an increase compared to the historic lows seen during the pandemic, they remain lower than rates from previous decades.

Higher mortgage rates can mean higher monthly payments, which may push some potential buyers out of the market. However, it’s essential to consider that home prices have also risen, meaning that even with lower rates, affordability remains a pressing issue for many.

In response to the higher rates, some buyers are exploring creative financing options. Programs for first-time homebuyers and rate buy-downs are becoming more popular as buyers seek ways to mitigate the impact of higher borrowing costs. Understanding these options can make a substantial difference in securing a home in a competitive market.

3 Proven Strategies for Buying & Selling at the Same Time

For those looking to buy and sell simultaneously in the South Jersey Housing Market 2024, having a solid strategy is vital. Here are three proven strategies that can help streamline the process:

- Sell First, Buy Later:

One common approach is to sell your current home before purchasing a new one. This strategy allows you to have a clear understanding of your budget and provides leverage when negotiating for your next home.

- Buy Contingent on Selling:

Another option is to put your home on the market with a contingency that allows you to find suitable housing before finalizing the sale. This method can provide peace of mind, knowing you have a home to move into before selling your current one.

- Simultaneous Transactions:

In some cases, buyers opt to close on their new home while their current home is still on the market. This strategy often requires careful financial planning, such as bridge loans or temporary financing solutions, but can be effective with the right preparation.

Regardless of the strategy chosen, having a knowledgeable real estate agent to guide you through the process is invaluable. They can help navigate the complexities of simultaneous transactions and ensure that you are making informed decisions.

FAQ

Here are some frequently asked questions regarding the South Jersey Housing Market 2024:

What is the current median home price in Burlington County?

The median home price in Burlington County is currently around $380,000, reflecting a competitive market with rising prices.

How long do homes typically stay on the market?

Homes in Burlington County are selling quickly, with an average of just 30 days on the market, and some towns experiencing even faster sales.

What should buyers do to prepare for a competitive market?

Buyers should get pre-approved for a mortgage, work with a local real estate agent, and be ready to make strong offers quickly when they find a suitable home.

Are there first-time homebuyer programs available?

Yes, there are various programs available that offer financial assistance and lower mortgage rates for first-time homebuyers in New Jersey.

Top South Jersey real estate team helps individuals and families with relocating, first home buys, and upsizing.

FREE RESOURCES

WATCH OUR videos

We streamline your real estate journey by understanding your needs and locating your perfect home.